If you ever made an investment in any mutual funds schemes such as:

- Equity funds

- Debt funds

- Liquid funds

- Or any other…

Chances are you are already paying 1-2.5% expense ratio. That means, if you are investing INR 100000, you are technically only investing 97,500 or 99000 depending on the expense ratio. You are straight away losing anywhere between 1000-2500 in every SIP.

The important thing for you to know is that there is one part of the expense ratio that could be saved if you understand how the expense ratio works.

For your long term wealth creation and financial freedom, you should know about the expense ratio. This could help you save more than 10-15 lakh in 10+ years.

In this exclusive guide, you will learn the following:

- What is an expense ratio

- What is the management expense ratio

- How knowing expense ratio will help you

- How to check your mutual fund investment expense ratio

- What to do about expense ratio

A backstory:

I have been investing in the mutual fund for almost 4+ years, and it was only last year when I learned about the mutual fund expense ratio. Initially, I did not care about this, but as I made a calculation based on my investments, I was awestruck.

I realize this knowledge gap is so big and something should be done about it. This is my contribution to help you understand more about the expense ratio which could help you save significant money in the longer run.

Also see: Best Robo advisory services in India

Moreover, you would know if your financial advisor is suggesting those mutual funds which are making him rich but not you.

Page Contents

What is a mutual fund expense ratio?

The expense ratio is the operating cost of a mutual fund that is paid by investors as management fees.

There is one part of this which is mandatory and another part that could be saved with little education. My goal with this guide is to educate you about the same and help you save money now and make more money in the long term.

The mandatory part of the mutual fund:

Let’s learn more about the expense ratio before we get to the money-saving part.

The expense ratio is annual fund operating expenses, which is charged by every mutual fund company to pay the asset manager. Every mutual fund scheme is managed by an asset manager and it’s their job to actively manage stocks and asset allocation to give a return. The asset manager works with analysts, auditors, advisors and other aspects of managing the mutual fund. (administrative and other operating expenses). The Expense ratio is also known as a management expense ratio (MER).

This management expense ratio could be anywhere from 0.1-2.5% of the fund value.

However, there is one more expense ratio that you can easily save, but to understand that, let’s understand the basics of mutual funds scheme.

Every mutual fund schemes have two plans:

Regular plan (R) and Direct plan (D)

The above expense ratio is part of both the plan.

The regular plan is significantly costlier than direct plans. However, both plans are exactly the same and have exactly the same percentage of stocks in their portfolio. It is no brainer that for any investor, it is more profitable to pick the direct plan over the regular plan.

The reason for regular plans is costlier because regular plan mutual funds have an additional expense ratio, which most of the investors are uneducated about. Let’s call it a hidden expense ratio that most of the innocent investors pay without knowing.

All the investment that you make via a financial advisor, CA, Banker, broker or agent, they recommend regular plans as this additional expense ratio is given as a commission to them.

This additional expense ratio could be anywhere between 0.1-1.5% depending upon the scheme and asset class.

Example:

- Equity-based mutual fund scheme: Usually 0.4-1.5% additional expense ratio.

- Debt fund: 0.1-0.6% expense ratio

According to statistics of mid-2019:

Only 15% of all mutual fund investments are in the direct plan and 85% mutual funds are in a regular plan.

As investors understand that a direct plan helps them make more money, they are switching it. However, this is limited to educated users who are learning about mutual funds and have slowly started managing funds themselves.

Read: How to switch from regular funds to direct mutual funds

When you are checking your mutual fund investments, you will not be able to see this additional expense ratio because it’s not mentioned in a way that you could see.

However, there are ways you can check the expense ratio of your investments and also calculate how much money you are losing because of this.

Also see: How to track all your mutual fund portfolio at single place

How knowing about the expense ratio could help you in making more money in the long run?

Back in the days when there was a lack of information and there was very little way for these mutual fund companies to reach to retail investors (like you, me and others), it is because of these brokers, and commission agent that they were able to educate the investors about benefits of mutual fund investment.

Moreover, it was practically impossible for any job going individual, homemakers, or people in different trade to invest in mutual funds.

So, these commission agents, brokers’ role and additional expense ratios were justified.

However, these days, many of us can educate ourselves and do mutual fund investments ourselves.

In such cases, you or anyone else don’t need to pay this additional expense ratio by investing in regular mutual fund plans.

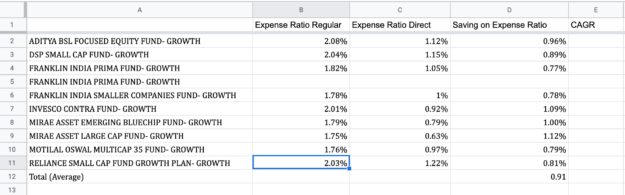

Comparative analysis of expense ratios

Let’s compare the expense ratio of some of the popular mutual fund scheme

| Mutual fund scheme | Type | Expense Ratio (Direct) | Expense Ratio (regular) |

| Franklin India Prima Fund | Equity: Mid Cap | 1.09% | 1.88% |

| Aditya Birla Sun Life Focused Equity Fund | Equity: Large Cap | 1.22% | 2.13% |

| Axis Small Cap Fund | Equity: Small Cap | 1.31% | 2.48% |

As you can see clearly from the above comparison table, by investing in the direct plan over the regular plan, you would be saving almost 1% on average.

Note: The Expense ratio should not be your only criteria to pick the scheme. However, knowing about the difference between the expense ratio of the regular and direct plans could help you a lot.

How to check your mutual fund investment expense ratio

Alright, now, let us learn how you can check the expense ratio of any mutual fund scheme.

The easy way is to check for the expense ratio in your scheme document. However, let’s be honest; most of us don’t want to read such a lengthy piece of document.

There are websites like:

which will let you check the expense ratio of any mutual fund scheme.

Here is how to do this:

Check your investment and find your fund name.

For example: Axis Small Cap Fund

Now, head to value research online site or simply search google with your fund name. Click on the Valueresearchonline or Moneycontrol link. Or simply go to their site and use the search button to

Under the fund name, you will see the option to switch between regular and direct plans.

Screenshot 1: See the direct plan expense ratio which is 1.31%

Screenshot 2: Expense ratio of the same scheme for the regular plan

Typically, if your invested fund does not have “Direct” written in it, then you have invested in a regular plan.

To get the hang of it, it’s a good idea that you make an excel and compare the expense ratio of direct vs. regular to find how much you paying extra. (See example screenshot below)

What to do about the expense ratio?

If you have made it toll now, then congratulations.

So far, this is all you have learned:

- What is the expense ratio in mutual funds

- Types of expense ratio

- Comparative analysis of Expense ratio

- How to check your expense ratio

Here you have a few choices:

- Switch the funds from regular to direct schemes.

- Stop the existing SIP and start new SIP in the same funds (Direct)

- Keep your fund as it is.

A lot depends on how much you understand about mutual fund investment and how well versed you are or will be in managing it. An average investor who has 1-2 SIP can easily do it themselves using a Robo-advisor app such as Goalwise or Groww or PayTM money app.

Read: Goalwise review: Pros/cons and how to start using it

However, there are many factors in play for example:

- Switching funds could cost exit load

- How to know if a fund is no more good and reliable in the future

- The hidden cost of switching mutual fund schemes

In the upcoming section of this series, I will help you get an answer to all these questions.

For now, my goal is to help you understand about expense ratio and why it matters. If you have an additional question about it, do let me know.

Disclaimer: I’m an average joe who is investing in getting financial freedom. I’m not certified for such advice. So, kindly DYOR before jumping into the conclusion.