Mutual funds are one of the biggest investment vehicles for Indian investors. With the expected return of 10-15% in the 5+ year horizon, it is a popular choice among investors of every size.

If you are someone who has been investing in mutual funds from different platforms, via different financial advisors, you may want to keep an eye on your mutual fund investment from a single platform.

Most of the financial advisors provide you with their own platform to let you check your portfolio and which works perfectly if you have only invested via one person. But, if your story is like me or many others who have invested via a different platform, then it’s important that you should be able to check all your mutual fund investments from a single platform.

Here in this guide, I’m sharing a few options that you have to see all your mutual fund investments from a single platform. So without further delay, let’s get to it.

Before that, read our popular mutual fund’s investment-related guides from ShoutMeTech:

- How to switch from Regular mutual fund to direct fund & Save money

- Best Robo advisory services in India

- Expanse Ratio in mutual funds: Everything Beginner investor needs to know

To be able to track your mutual fund investment in one place, your mutual fund folios should have an email address. If it is not there, you can ask your financial advisor to add your email address to your mutual fund.

Tip#1: If you have used multiple email addresses in the past, then you should start putting every investment of yours using a single email address. You can update past investments with that single email address.

Tip#2: Whenever you make a mutual fund investment, keep a track of fund name and the folio number in one place (Use Google sheet or something similar).

Page Contents

Best platforms to track mutual fund portfolio:

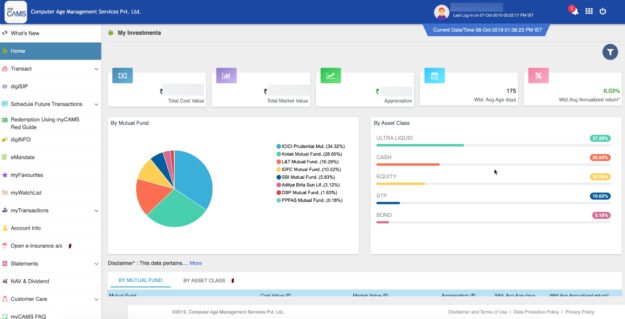

MyCams:

- Charges: Free

- Easy of Use: Beginner-friendly

- Platform: Web, Android, and iOS

MyCams is an online portal of CAMS (Computer Age Management Services ). Using MyCams you can see all your mutual fund investment from a single place.

Here is how it works:

- Head over to MyCams and register an account with email address (The one that you use for your investments)

- Log in with your email and password and you will see the dashboard something like this

From a single platform, you have access to all the data related to your mutual fund investments. Apart from this, you could do a lot more such as:

- Switch your funds from the regular plans to direct plans and save on the expense ratio.

- See all your recent transactions

- Your investment and fundholding

- Sell your mutual fund investments and a lot more

- See investments based on the various asset class

In my opinion, every mutual fund investor should know about MyCams and should be using it.

Sign up for MyCams | Download Android App | Download iOS app

Goalwise – Track your family mutual fund portfolio as well

- Charges: Free

- Easy of Use: Beginner-friendly

- Platform: Web, Android, and iOS

These days there are many robo advisor platforms that offer a data-driven approach to help you invest. Most of these Robo-advisor platforms also let you track your investment from one place.

The commonality in all these platforms is, they get the data via MyCams and you need to periodically send the updated email-statement from MyCams to see the latest data.

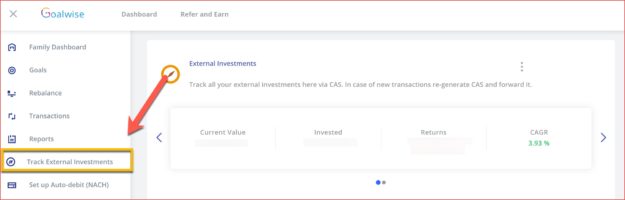

One such Robo-advisor platform is Goalwise which lets you track yours and family member’s investments. Using the platform is easy and here is what is required:

- Create an account on Goalwise

- Log in and click on external investments

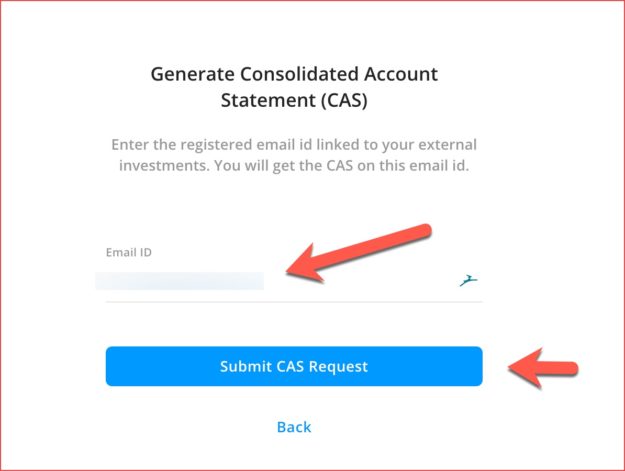

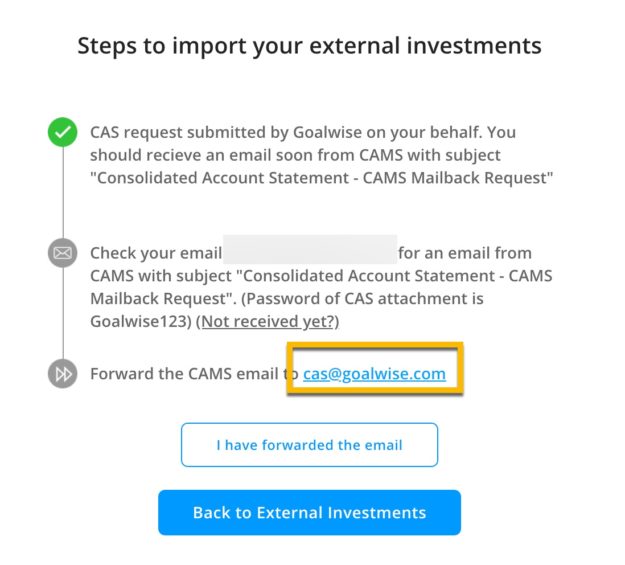

Click on regenerate CAS and add your email address to receive the CAS (Consolidated Account Statement) report.

Click on submit CAS request. Within a few minutes, you will receive an email my MyCams (The above platform) with a .pdf of all your mutual fund investments.

Simply forward that email to the one shown on your screen and within one minute, you will be able to track your mutual fund investments.

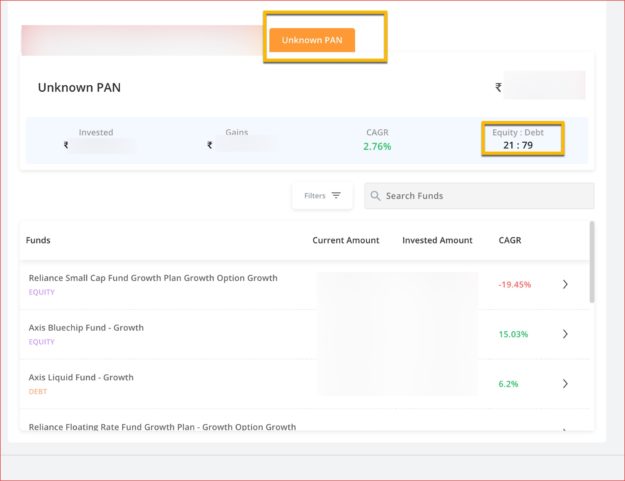

On Goal wise, you can repeat the process for investment done under your family name. The best part is, all the investment will be sorted under the PAN card name, which makes it easier for you to see the portfolio separately.

There are a few untold benefits of using Goalwise to track your external mutual fund portfolio:

- You can see the investment which has missing PAN card details.

- You could see the proportion of your equity and debt investment (See above screenshot)

- You can switch your regular funds to direct funds and earn an extra 1% which is usually taken by the mediator. (However, you should do it only when you are confident about what you are doing)

Read: Goalwise review: Pros/cons and how to start using it

Like Goalwise, there are more similar platforms that you can use for tracking your mutual fund’s investments. Here are a few that you could check out:

I will update this guide with more resources as we move ahead. For now, go ahead and get an overview of your investments in one place.