Do you want to make more money by switching from Regular funds to direct funds?

If your answer is yes, then this guide is for you.

And if your answer is No, then this guide is for you as well because you will learn something new.

Note:

I have done my best to simplify the concept for beginner and intermediatory level investors. This guide is for information purposes only and is not a piece of financial advice. The concept mentioned is not idle for novice investors. So take this action when you are sure of what you are doing and aware of all the concepts like the exit load.

**You should consider switching when you can manage your investment yourself and is not dependent on your advisor or distributor.

***It is also important that you inform your advisor before switching. A genuine advisor would put his client interest first before his/hers.

Page Contents

A little background:

I have been investing in mutual funds from the past 4+ years and I have two investment advisors who are doing a great job managing my funds. Everything was great until the last bear market when my investment was negative. That’s the time I started learning and understanding more about mutual funds and how this whole system works.

This is when I learned about the Expense ratio and learned about Robo advisory services. Moreover, we almost pay 1.5% of our every investment (Including every SIP), as a commission which not many of us are even aware of.

Having an advisor has its own benefits in some cases, which actually is better in many ways than investing of your own. I will discuss more on it in some upcoming posts.

However, like any other skill, I believe investment could be learn by anyone who makes an effort to learn it. Moreover, you would be saving in lakhs, if not crores, in a 10-20 year period.

Especially, when you are retiring and your income has stopped coming, this significant saving would help you get going when things get tough.

However, before I share some numbers and other data lets understand a concept in simple words:

Every mutual fund scheme offers two scheme:

One is direct and one is regular.

There is no difference in both of these apart from the fact, your broker or advisor will always buy Regular scheme for you.

Wondering why?

It is because the Regular plan is almost 0.5%-1.5% costlier than the direct plan. This additional cost is part of the expense ratio which is paid to the broker/commission agent/financial advisor pocket.

In many scenarios, this extra charge is ok if your funds are being managed actively and you don’t have the capability of learning and managing it yourself.

However, if you are someone who likes to learn (It’s not tough to learn about mutual fund investment), you can invest in the direct mutual fund and save that extra expense ratio. I do recommend you read about the Expense ratio once to learn the basics of it.

Now, what’s interesting here is:

You can anytime switch from Regular fund to direct fund and save that additional 1.5%, especially, if your funds are not being actively managed. If you have invested via a broker, you can switch those regular funds to direct funds to grow your wealth.

Here is a rough calculation to understand how much money you would save in 20 years period if you would pick direct over regular funds.

For this, I’m taking an example from Axis Bluechip Fund

| Tenure (25000 INR/month SIP) | Regular plan | Direct plan (25000/month SIP) | Difference (IN INR) |

| 1 year (10% return) | 3,13,513 | 3,15,078 | 1,565 |

| 5 year (10% return) | 1,914,031 | 1,969,283 | 55.252 |

| 10 year (10% return) | 4,996,596 | 5,314,632 | 318,036 |

| 15 year (10% return) | 9,961,099 | 10,997,594 | 1,036,495 |

| 20 years (10% return) | 17,956,481 | 20,651,612 | 2,695,131 |

That means you would be earning an extra 26.95 lakh in 20 years if you switch from regular fund to direct fund. To give you more perspective, this 26.95 lakh value is about 7 lakh INR in today’s date (Calculating inflation at the rate of 7%).

Note: In this calculation, I have taken Axis bluechip fund as an example.

The direct plan expense ratio of Axis bluechip fund is: 0.81 and the Regular plan Expense ratio is: 1.99%. I have added the difference of 1.18% in the direct plan returns.

Update: Thanks Sanchi for pointing out about the return on the long term. The difference is actually higher than 1.18%

Another example:

Let’s understand from another example which many of you can easily relate. Especially if you have invested in an ELSS scheme.

In this case, Mr. X invested one-time of 1 lakh in an ELSS scheme and let’s assume it is “Invesco India Tax Plan“

Here is the return for both the funds in a horizon of 5 years:

| Investment (One time) | 1,00,000 | |

| Direct plan return (5 years) | 12.98% | 184,080 |

| Regular plan return (5 years) | 11.16% | 169,723 |

That’s basically a loss of almost 14k for you just for an investment in an ELSS scheme.

Isn’t it a huge number for anyone?

Do you understand why you have paid 14K here for?

Do you understand how you could have saved your 26 lakh INR in the long run?

Just for knowing what scheme to invest?

The situation may differ in the case of a different individual, but you need to do more due diligence and aware of what you are losing in the longer run. And, when there is no guaranteed return. It’s all subject to market conditions.

This is why it is important for you to learn more about mutual funds and start investing yourself. In the longer run, these few hours of regular learning would start paying for itself.

Before, I share the various ways by which you could make the switch from regular mutual fund to direct funds, here are few guides that I have published earlier which you should read:

- How to Track all your Mutual Fund Investments in one Platform

- Best Robo Advisor Services in India For Smart Investing

- Expense Ratio in Mutual Funds: Everything You Need To Know

Alright, if you have speed read all the above guides, it’s time to learn how to switch mutual funds.

Note: At the end of this guide, I have added a few important points regarding mutual fund switching. This will help you to avoid extra cost which you may end up paying in terms of exit load.

But before that, let’s learn the art of switching mutual funds.

Best ways to switch from a regular plan to direct plan mutual funds:

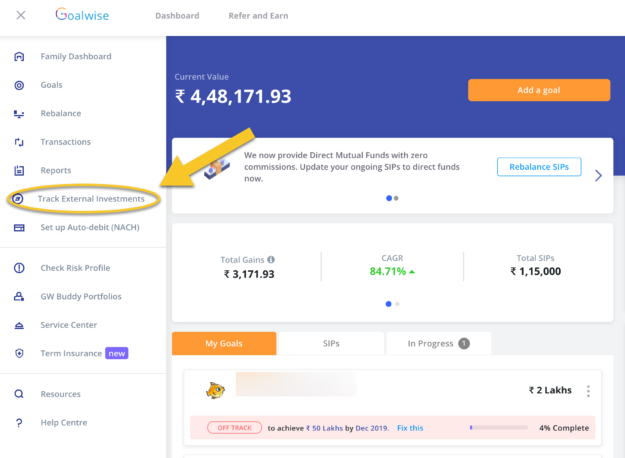

Using Goalwise:

I have talked about Goalwise before in my best Robo advisory apps guide. Goalwise lets you invest in direct mutual fund and do offer an option to move funds from regular to direct funds.

However, this is useful only when you are using Goalwise to manage your funds. In many cases, it is much better to use Goalwise as it offers all advanced feature which will help you to make wealth.

The best part is the platform is easy to understand even for beginners and they offer an excellent support system. Here is how to use Goalwise to switch from regular mutual fund plans to direct mutual fund plans.

- Register an account on Goalwise

- Login to Goalwise dashboard

- Head over to “Track external investments”

Follow the on-screen steps to generate a consolidated account statement. What this will do is, it will help you receive a .pdf attached email which will contain all your mutual fund investments. I have shared all the steps earlier in this tutorial.

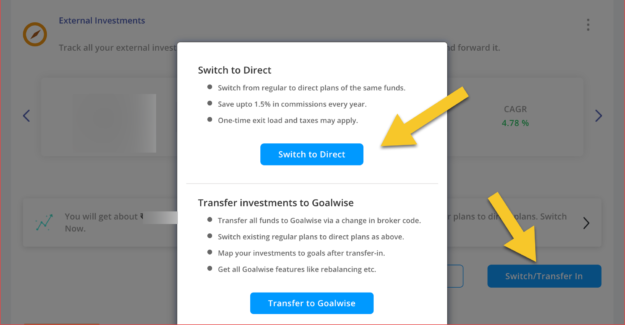

Once you have started tracking external investment on Goalwise, you have an option to switch all your funds from regular funds to direct funds on the same screen.

Few things to know about “Switch to direct” feature:

- Switch from regular to direct plans of the same funds.

- Save upto 1.5% in commissions every year.

- One-time exit load and taxes may apply.

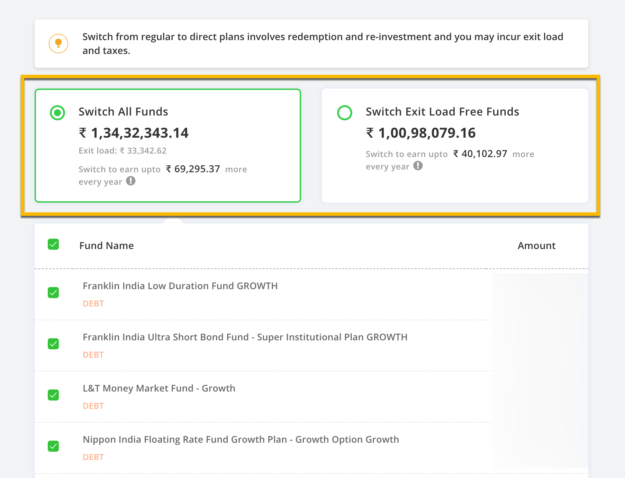

The best part about the Goalwise switching feature is, you can selectively switch only those funds that do not incur exit load.

It also provides all the data like how much you would be saving every year after switching. In case if you are not sure about switching, use this calculator to find out how much you are saving in 10-15 year terms.

Read: Goalwise review: Pros/cons and how to start using it

Once you are ready, click on proceed and move the fund to direct.

Similarly, Kuvera is another app that offers smart switching from regular to direct fund. However, the interface is not as neat and easy to use as Goalwise.

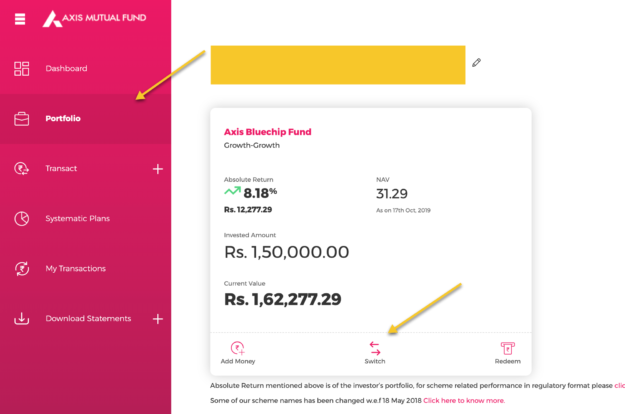

Using individual mutual fund house

Even if you have purchased the funds via a distributor, financial advisor or broker, you can always log in to the mutual fund online portal and make the switch directly.

For example, in this case, I have invested in Axis bluechip regular plan and to make the switch, I need to login to Axis mutual fund website. A simple google search will take me to the mutual fund house member page.

The login could be done using your Pan card, email address or even phone number.

Once you logged in, you will see all your portfolio and investment. Different mutual fund schemes will have a different dashboard layout, but the method is more or less going to be similar as shown below.

After clicking on the switch, you will have the option to switch funds directly to a direct plan.

This is how you will repeat the steps on all your mutual fund investments.

Using CAMSOnline site:

CAMS is another website where you can see all your mutual fund investments and also make a switch from regular to direct plans. However, the process is not as simple as what is offered by Goalwise. But it works.

Offline switching method:

The above method works when you have an email address of PAN ID attached to your mutual fund folio.

For old investors or for new who don’t have an email address attached or the above methods are not showing on your mutual fund folio, you can ask your broker/distributor/financial advisor/commission agent to add an email address to your folio.

You can also use the update KYC feature of the folio to add an email address to any existing folio.

- Else, you can walk to the nearest branch of your mutual fund folio

- Ask them for switch form and make the switch.

In some cases, you need to make redemption of the folio and make a fresh investment in the direct plan of the same mutual fund.

Important points before you switch from Regular scheme to direct scheme:

As I said above, you need to consider a few important points before making the switch. I’m highlighting some points that would help you plan and strategize mutual fund switching:

Switching from regular to direct scheme is Taxable event:

Regular plan to direct plan switching is a taxable event. So, you should wait for at least one year after making the investment before making the switch. Short term capital gain (<1 year) is taxed at 15% and Long term capital gain (>1 year) is taxed at 10%. Also, LTCG is taxed after 1 lakh.

Change in SIP:

You need to stop SIP to your regular mutual fund and start a new SIP to your direct fund.

Exit load:

Most of the mutual fund schemes have a 1-3 year exit load time. That means, if you are withdrawing funds before the defined period, there will be an exit load which is considerable and reduce the redemption price.

You can check the exit load condition of any mutual fund on the Value research online website.

Financial advisor:

Relationship with your advisor also plays a great role, and what you need to remember is, your relation is built on growing your money.

This should also be considered when making the switch. If your existing financial advisor/broker is adding extra value to your investment or generating alpha consistently, then you should rather stick with your advisor.

But if your advisor is invested in few mutual funds and only telling you about compounding and stay invested for 5-10 years plus, in such a scenario, you should consider moving your funds.

Note: Instead of one-time redemption, you can also use STP to switch.

Conclusion:

For anyone who believes that they can manage their funds and is not become a hurdle to their main business/occupation/profession, switching from regular to direct plan makes a lot of sense.

Years back, it seemed impossible to make mutual fund investment ourselves and distributors/advisors/brokers have done a significant job by helping others invest.

I believe as Uber has disrupted the taxi industry and made the life of billions of end-users easy in terms of commuting, similarly, apps like Goalwise are doing for the mutual fund industry.

Such Robo advisory apps are removing the requirement of middle-man and letting investors invest without worrying about the nitty-gritty of mutual fund investment.

If I have to pick one method from all of the above, I recommend using Goalwise for switching from regular to direct mutual fund. In the future, you can also use Goalwise to manage your portfolio as they offer direct funds and help in fund selection and portfolio rebalancing.

I’m pretty sure you may have some experience and story of yours about switching from regular to direct mutual funds. It would be nice if you could share it with us in the comment section below.

Comments on this entry are closed.

Hello Mr.Harsh Agrawal,

I strongly agree wtih your points.

The benefit of the direct plan is the lower cost ratio compared to the regular plan.

The reason is that you buy the units directly from the fund house. There are no broker, agents or distributors.

Yes, Obviously! A good thing to do. 🙂

thanks for sharing this article. i can now switch from a regular plan to direct plan mutual funds easily unlike before i could not do it.